To avoid the obvious potential for conflicts of interest, North Carolina used independent administrator Accion Group to select winning projects from the 78 submitted. Of the 14 winning projects announced, six are to be built by Duke entities, while the remaining will be built by developers not identified in the release.

Duke's slewing drive own projects, sited in North Carolina, will be built by three company divisions: Renewables, Energy Carolinas and solar slewing drive Energy Progress.

Duke's six projects solar damper add up to 270 megawatts and are expected to be complete solar inverter by 2020.

While Duke solar slewing drive didn’t reveal cost figures in its Wednesday press release, a report from Accion Group provided some data points on the capital slewing drive costs and energy costs involved.

The report noted that the average energy price per proposal was $36.93 per megawatt-hour for North Carolina projects and $31.24 per megawatt-hour for South Carolina projects — both lower than the cost of solar prior to the program’s launch.

Duke noted that these avoided-cost savings are expected to add up to about $375 million over the projects’ 20-year contract period.

Accion Group’s report estimated the capital costs of the projects at $1 million to $1.5 million per megawatt, excluding land costs.

Applied to the contracted solar for both North and South Carolina, the report estimated the projects’solar inverter capital costs will be between $515 million and $773 million solar tracker actuator for the 515 megawatts of solar to be built in North Carolina, and between $87 million and $131 million for the 87 megawatts to be built in South Carolina.

In terms of Duke’s 270 megawatts of projects, the figure would be between $270 million and $405 million.

HB 589, the 2017 law that created North Carolina's competitive renewables procurement program, sets a variety of new solar market mechanisms in place, designed by its backers to pass muster in the state’s Republican-dominated state legislature. Those included the competitive solar solicitations just announced, as well as a statewide rooftop solar leasing program, and the Green Source Rider Program, which allows large utility customers to offset their electricity usage with renewable energy.

Duke Energy is a big player in renewable energy development outside its regulated markets. But the utility group has also been a long-time solar tracker actuator proponent of giving its in-house solar damper regulated utilities some role in owning the assets that make up a modern, renewable energy-powered grid, such as grid-tied batteries,solar tracker actuator electric vehicle charging infrastructure, microgrids, slewing drive and some behind-the-meter assets.

Last year, the utility sought permission to enter the North Carolina commercial solar rooftop leasing market through a non-regulated subsidiary — a move that would Photovoltaic holder meet with fierce opposition from third-party developers in California, but which in North Carolina Photovoltaic holder could be seen as a way for Duke to boost a market that’s still in its infancy.

North Carolina continued to lead all states except California in terms of solar market growth solar inverter in 2018, according to last month’s U.S. Solar Market Insight 2018 Year in Review report from Wood Mackenzie Power & Renewables and the Solar Energy Industries Association.

Revolutionising sugar mill efficiency: Mill Gears unveils world’s largest gearbox

Revolutionising sugar mill efficiency: Mill Gears unveils world’s largest gearbox

who are the leaders in solar trackers for the power industry?

who are the leaders in solar trackers for the power industry?

Trina releases new version of Vanguard 1P solar tracker

Trina releases new version of Vanguard 1P solar tracker

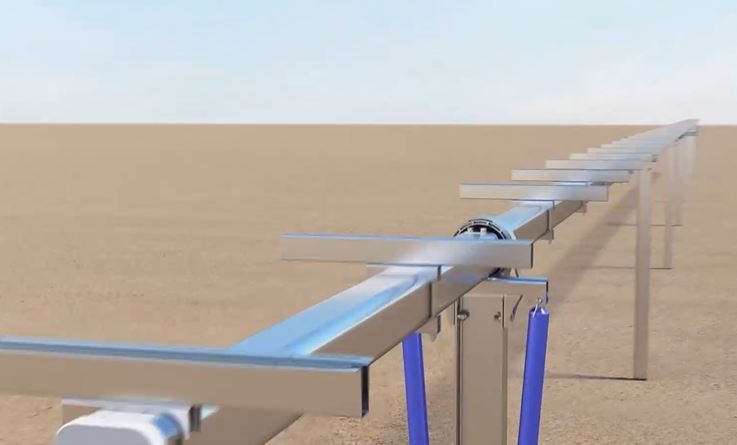

GameChange Solar Tests Tracking System for 40-Year Lifespan

GameChange Solar Tests Tracking System for 40-Year Lifespan