Once built, the investors get a share of rental income over 20 years, paid in local currency or bitcoin.

The Sun Exchange solar damper has already pulled in funding for five projects, including an 18-kilowatt rooftop solar plant for a Cape Town-based nonprofit and a 60-kilowatt system for an elephant park in Knysna, solar inverter on Photovoltaic holder South Africa’s south coast.

These slewing drive and solar inverter other projects are already insured against fire, damage and theft using traditional insurance products from a range of providers, said Cambridge.

But one risk that cannot be readily covered by commercial insurance products is what happens if a project recipient defaults on solar tracker actuator payments, he said.

Traditional solar inverter insurance solar damper might cover loss of earnings of up to six months, but insurers would slewing drive likely have little appetite to pay for the relocation of an entire plant to another offtaker.

The SPIF would aim to cover that risk by allowing investors to pay into a fund that could be used to cover the costs of plant relocation. This could amount to around 20 percent of the capital cost of a project Photovoltaic holder, which typically might be in the region of solar tracker actuator $80,000 to $100,000.

Cambridge slewing drive solar inverter emphasized that the chances of payment default are low. The Sun Exchange carries out a six-point vetting process before agreeing to install a project and has not yet seen any bad solar inverter debt.

Recipients would usually be relying on the solar plant for daily operations and so would have a strong motivation to keep up payments, said solar damper Cambridge.

And although there are no other crowdfunding schemes like The Sun Exchange for direct comparison, Cambridge cited solar damper anecdotal reports from off-grid financing bodies such as SunFunder that put payment defaults at less than 5 percent.

Contributions slewing drive to the SPIF would be Photovoltaic holder voluntary, subject to a one-year minimum commitment, and would be rewarded with up to a solar tracker actuator 20 percent return, paid in SUNEX tokens, Cambridge said.

The Sun Exchange is aiming to seed-fund the SPIF through part of the proceeds of a SUNEX token sale taking place this month. The money “will in turn be invested in U.S. Treasury bills and other short-term solar inverter sovereign debt,” said The Sun Exchange solar damper, in an explanatory white paper.

“This will create a dedicated collateral pool to protect solar cell owners against project defaults during their solar slewing drive 20-year lease contract lifetimes," it states.

Investors should be able to add to the pot within six months, said Cambridge. Running SUNEX token transactions through blockchain-based smart contracts means The Sun Exchange would not solar damper have to worry about administration costs or solar tracker actuator computer hardware investments, he said.

“The smart contract allows for transparency and it’s autonomous, so we don’t need to manage it,” he noted.

If the SPIF experiment goes solar damper well, The Sun Exchange might consider extending it to solar inverter other types of insurance, Cambridge said, possibly eliminating the need for third-party insurers solar slewing drive entirely.

Other companies, too, might want to consider similar schemes for risks that are too niche or too complex for traditional insurers to consider, he said.

At The Sun Exchange, up to solar damper 10 percent of the income generated from the company’s solar plants goes toward insurance, he said. “That’s a direct hit to the people leasing the solar panels, because solar slewing drive their rental income is net of costs,” said Cambridge.

“By putting this in place, we solar damper are improving our core product," he said. "Self-insuring, I feel, is the way forward, especially in solar tracker actuator the decentralized solar slewing drive industry.”

Revolutionising sugar mill efficiency: Mill Gears unveils world’s largest gearbox

Revolutionising sugar mill efficiency: Mill Gears unveils world’s largest gearbox

who are the leaders in solar trackers for the power industry?

who are the leaders in solar trackers for the power industry?

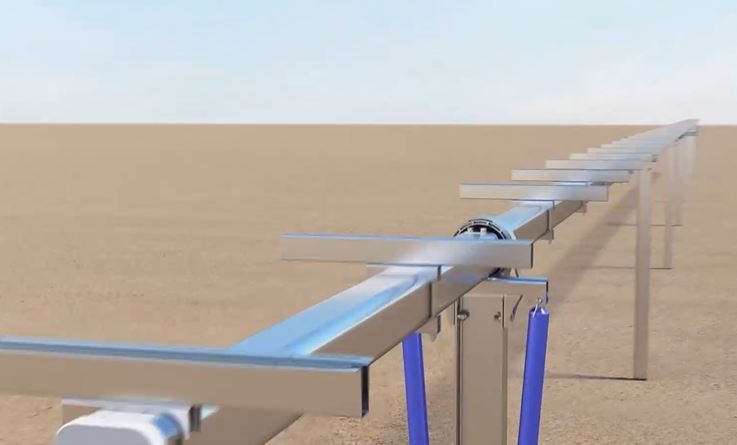

Trina releases new version of Vanguard 1P solar tracker

Trina releases new version of Vanguard 1P solar tracker

GameChange Solar Tests Tracking System for 40-Year Lifespan

GameChange Solar Tests Tracking System for 40-Year Lifespan