The money will also allow solar slewing drive CleanCapital to increase its focus on segments solar inverter such as energy efficiency, storage, and new construction solar.

“Those are all markets that need this...long-term capital to arrive,” slewing drive said Byrne.

CleanCapital solar tracker actuator acquires assets, its platform then aggregates and bundles them, offering them to a slewing drive variety of investors. According to the company, the speed of their analysis allows complex deals — which can take months — to solar inverter close in less solar damper than 60 days and widens the types of investors focused on the hard-to-finance space.

“It’s all centered on us being able to take in projects more quickly, and to underwrite them more rapidly and accurately so we can put together large pools of assets. That’s what we do,” said Byrne. “We try to aggregate as many assets as solar damper possible as quickly as possible.”

Though the funding partnership from CarVal comes in at an amount under previous investments, Byrne said the partnership does indicate Photovoltaic holder growing confidence in clean energy among mainstream investors.

CarVal, a solar tracker actuator division of Cargill, specializes in direct investments in the areas of real estate, loan portfolios, corporate securities, and special opportunities. That last category has included debt and equity for power projects, according to Bloomberg.

“It’s also really solar inverter telling that an investment firm like CarVal is now eagerly getting into clean energy,” he said. “That’s exactly what we’re trying to accomplish: How do you get the institutional capital that has so far been on the sidelines of this sector?”

CleanCapital’s focus on Photovoltaic holder commercial and industrial solar slewing drive projects offers a funding line to an area of the solar market that has potential — an estimated solar damper 20 percent of the possible solar market — but has been held back by investment challenges. Byrne also emphasized that distributed projects like those CleanCapital supports are central to meeting climate goals.

“This is solar tracker actuator an area that has desperately needed better capital solutions,” said Byrne. “The C&I sector is simply a segment of the market that has not had these financing solutions.”

GTM Research Senior Solar Analyst Michelle Davis said the size of CleanCapital’s raise is in line solar inverter with the commercial solar inverter industry, if on the higher end. In October, for instance, True Green Capital and SunPower collaborated on $140 Photovoltaic holder million for commercial solar projects in the U.S. But Davis said CleanCapital’s model does differ from other financing companies.

“It’s interesting that they’re investing private equity with potential debt financing included as well,” she said. “Most of the interesting new solar damper examples of financing that I’ve solar slewing drive heard of are either one or the other.”

When solar tracker actuator CleanCapital combines its $250 million financing with debt, Byrne said total acquisitions and investments stemming from the new fund could reach $1 billion with a 75 percent debt-to-equity ratio. CleanCapital's project investments generally do not include tax equity.

Davis said that $1 billion sum may be a bit inflated, but solar tracker actuator it’s hard to know.

“Typically, a commercial project has 40 to 50 percent of the capital stack as tax equity,” she said. “The rest is made up of either some portion of Photovoltaic holder debt or sponsor equity.”

According to Davis, GTM Research projects a total U.S. commercial market size of $2.5 billion to $3 billion annually solar inverter over the next five years.

Byrne slewing drive said CleanCapital expects solar damper further acquisition and partnership announcements in the next few months.

Join us for the 11th annual Solar Summit 2018 in San Diego, May 1-2. Powered by the unique blend of research and economic analysis from the GTM Research team, this year's agenda will feature themes from beyond traditional project slewing drive finance to innovations in solar and the solar tracker actuator transformation of solar damper electricity.

Revolutionising sugar mill efficiency: Mill Gears unveils world’s largest gearbox

Revolutionising sugar mill efficiency: Mill Gears unveils world’s largest gearbox

who are the leaders in solar trackers for the power industry?

who are the leaders in solar trackers for the power industry?

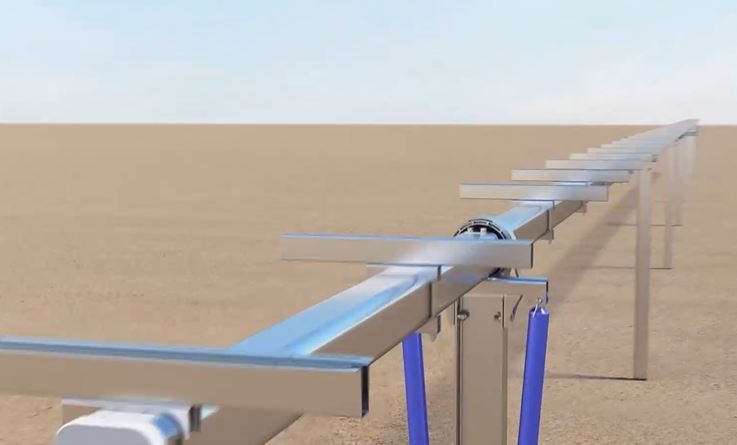

Trina releases new version of Vanguard 1P solar tracker

Trina releases new version of Vanguard 1P solar tracker

GameChange Solar Tests Tracking System for 40-Year Lifespan

GameChange Solar Tests Tracking System for 40-Year Lifespan