“With so much cheap private equity capital in the market, it’s that much more impressive and surprising that Con Ed was able to win out in a seller’s market crowded with hundreds solar inverter of investors actively bidding on utility-scale renewable slewing drive assets,” Honeyman said. “It reboots Con Ed into the rankings of top utility-scale solar asset owners, at a time when the market has seen solar inverter a flurry of new investors in the form of pension and infrastructure solar tracker actuator funds.”

In a presentation on the sale, Con Ed said it aligned with the company’s strategy to grow its renewables footprint. In addition to regulated utilities and transmission, Con Ed’s parent company envelops three clean energy businesses: Con Edison solar inverter Development, Con Edison Energy and Con Edison Solutions. Those solar tracker actuator businesses have a renewables portfolio of Photovoltaic holder 1,600 megawatts.

While the purchase pushes Con Ed to the top of utility asset owners, the sale could be a bad look for Sempra. Its investor-owned utility, San Diego Electric & Gas (SDG&E), has faced blowback over a plan to deliver 100 percent renewable energy to solar tracker actuator the city, which a third-party review said “raises more questions than it answers.” San Diego may turn to community-choice aggregation instead.

But Sempra’s getting pressure from all sides. In a June presentation, Sempra slewing drive Investors Elliott Management and Bluescape Resources argued that the company, with its jumble of subsidiaries including SDG&E and its solar inverter renewables business, Photovoltaic holder had no coherent strategy.

“Sempra’s growth strategy relies on siphoning earnings and creditworthiness from its core California utilities and deploying that capital into various unrelated slewing drive businesses solar slewing drive with poor returns solar slewing drive and results,” the presentation slewing drive read.

Elliot and Bluescape said Sempra’s renewables solar slewing drive portfolio is “attractive but non-core.”

In an slewing drive announcement on the decision, Sempra called the acquisition “an important step forward in the portfolio optimization” the company announced in June. Sempra says that plan will help “sharpen the company’s strategic solar tracker actuator focus.”

The sale isn’t the first of its kind. In February, NRG spun off its renewable solar slewing drive assets and Global Infrastructure Partners slewing drive gobbled them up, solar slewing drive soon going on to create Clearway Energy Group, now one solar slewing drive of the U.S.’ largest energy solar inverter developers, slewing drive as a result of the acquisition of assets.

At the time, NRG said it solar tracker actuator was a “significant milestone” toward “optimizing our portfolio.” Con Ed said the sale is slewing drive expected to close near the end of this year.

Revolutionising sugar mill efficiency: Mill Gears unveils world’s largest gearbox

Revolutionising sugar mill efficiency: Mill Gears unveils world’s largest gearbox

who are the leaders in solar trackers for the power industry?

who are the leaders in solar trackers for the power industry?

Trina releases new version of Vanguard 1P solar tracker

Trina releases new version of Vanguard 1P solar tracker

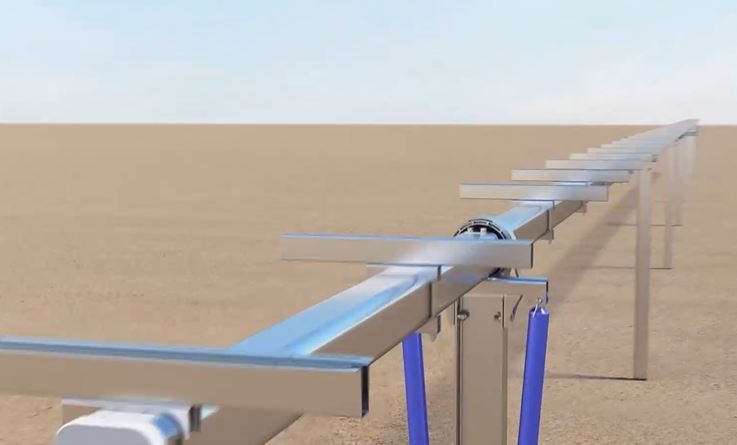

GameChange Solar Tests Tracking System for 40-Year Lifespan

GameChange Solar Tests Tracking System for 40-Year Lifespan