7X has found early success selling its electricity through block-and-index contracts — branded as its SolarBlocks program — as opposed to the traditional solar tracker actuator as-generated power-purchase agreements (PPAs). Certainty around how much power will be Photovoltaic holder delivered and when makes for an easier sell with corporations, an increasingly important buyer of renewable power in the U.S.

“We’re putting the weather risk on the project so the solar tracker actuator customer solar slewing drive doesn’t have to bear it,” CEO Clay Butler said in an Photovoltaic holder interview.

Taygete’s two corporate PPAs are for physical delivery in Texas’ ERCOT electricity market, to be settled at the hub, Butler said.

Texas is at the forefront of the corporate renewables boom in the U.S., thanks to its deregulated power market, strong economy and abundant supply of low-cost wind and solar power. While wind remains the largest source of corporate PPAs for now, solar is expected to narrow the gap over the next few years.

Last week Starbucks announced a partnership with solar developer Cypress Creek on eight Texas solar projects that will provide energy for 360 coffee solar slewing drive stores across the state.

For all of solar’s recent momentum in Texas, it remains a “very competitive marketplace” for developers, and transmission congestion is a roadblock, Butler said. “There have been a lot more solar PPAs signed lately in ERCOT but I don’t think it’s a feeding frenzy [of offtakers] at this moment.”

“Supply still outweighs demand,” he added.

Wood Mackenzie Power & Renewables is forecasting nearly 800 MW of new solar in Texas this year, and more than 1.9 Photovoltaic holder gigawatts in 2020 — before leveling out around 1.1 gigawatts annually through 2024.

Having sold its first two projects and now clinching solar tracker actuator PPAs for its third, 7X is plotting its next chapter — one that could see it become a force in markets beyond Texas. The company’s leadership team comes from a variety of renewables developers, including Pattern Energy and SunEdison.

Last year 7X made the solar slewing drive decision to expand into new markets, and is already finding “pretty good success, especially in PJM and the Western Interconnection,” Butler said.

More details on projects in those geographies solar tracker actuator are likely to be made public “in a couple of months,” he said. “It’s coming.”

Revolutionising sugar mill efficiency: Mill Gears unveils world’s largest gearbox

Revolutionising sugar mill efficiency: Mill Gears unveils world’s largest gearbox

who are the leaders in solar trackers for the power industry?

who are the leaders in solar trackers for the power industry?

Trina releases new version of Vanguard 1P solar tracker

Trina releases new version of Vanguard 1P solar tracker

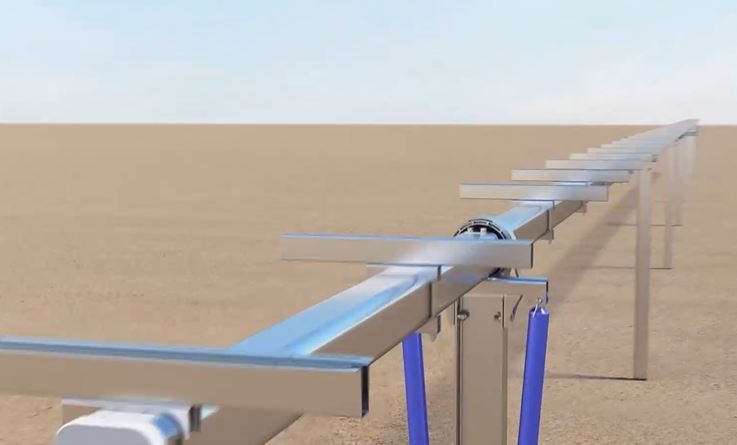

GameChange Solar Tests Tracking System for 40-Year Lifespan

GameChange Solar Tests Tracking System for 40-Year Lifespan